A comprehensive survey of 600 business leaders across major European markets reveals that privacy management has evolved from a compliance requirement to a strategic business priority, with nearly three-quarters of privacy decisions now being made at the executive level.

The study — which gathered insights from equal numbers of respondents in the UK, Germany, Spain, and Italy — reveals that privacy management has become a C-suite concern, with 73 percent of respondents being senior executives. Senior-level involvement in the planning of consent management within companies marks a significant shift in how organizations approach data privacy in an era when data privacy has gone global and far beyond just the GDPR.

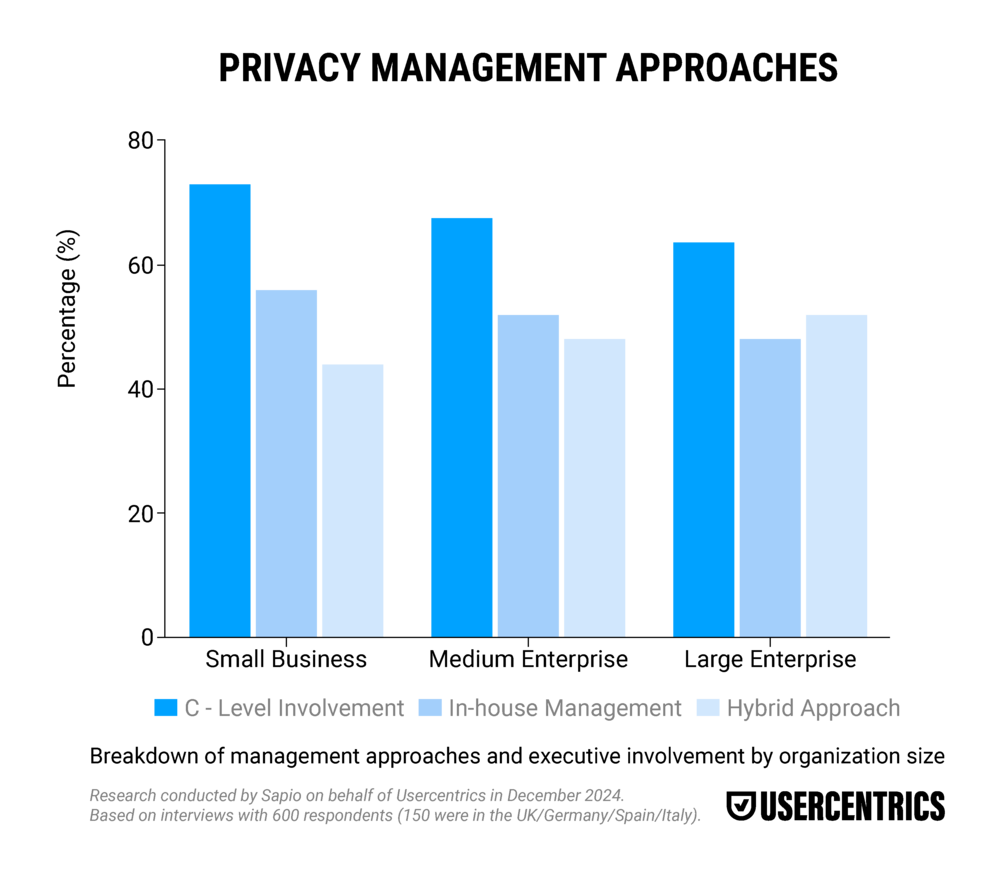

The research also shows a notable divide in privacy management approaches. Fifty-six percent of organizations handle privacy matters in-house, and 44 percent have adopted a hybrid approach that combines internal and external expertise. This split becomes more pronounced when analyzed by company size. Larger organizations are more likely to employ hybrid solutions due to the increasing complexity of privacy requirements.

Key findings include:

- Small and medium-sized businesses (SMBs) make up 76 percent of surveyed organizations, which reflects the European business landscape

- Organizations are actively seeking to balance direct control over privacy practices with access to specialized expertise

- Confidence levels in compliance vary significantly across organization sizes, with larger companies often expressing more nuanced concerns about regulatory requirements

Industry distribution in the survey suggests that sectors with the most digital customer interactions — software technology, professional services, and retail — are leading the way in privacy adaptation. This mirrors how digital transformation spreads across industries, with some sectors blazing trails that others later follow.

Privacy compliance as a strategic move

This survey provides a window into the future. The behavior of European businesses is particularly relevant because it reveals how markets mature and adapt when privacy regulations become a long-standing reality rather than a new development. The UK, Germany, Spain, and Italy are now considered mature markets when it comes to data privacy.

These markets represent the world’s most developed regulatory environments for data privacy. The EU has been at the forefront of privacy regulation since the Data Protection Directive of 1995, which then evolved into the General Data Protection Regulation in 2018.

This means European businesses of all sizes have had more time to move beyond initial compliance scrambles and develop more sophisticated approaches. Their behavior shows us the “steady state” of privacy management, rather than the reaction to new rules.

What this survey reveals about privacy strategy amongst European businesses contradicts the common narrative that regulations simply burden organizations. The European experience can serve as a predictive model for other regions.

Many markets, like California with the CCPA/CPRA, Brazil with the LGPD, and other jurisdictions currently implementing privacy regulations are following the European regulatory path to a greater or lesser degree. By understanding how European organizations have evolved, businesses in these emerging privacy markets can anticipate their own trajectories and potentially skip painful stages of adaptation.

This approach to privacy has become increasingly influential globally. Major technology platforms have often found it more efficient to adopt European standards internationally rather than maintain different privacy standards for different regions.

This “Brussels Effect” — the process of European Union regulations and best practices spreading well beyond its borders — means that European privacy practices often become de facto global standards. European business behaviors are often therefore leading indicators for global trends.

From a competitive standpoint, privacy-compatible business models, with solutions to balance personalization with privacy, data utility with data protection, and marketing effectiveness with user consent, provide valuable blueprints for organizations just beginning this journey.

The trend of elevating privacy concerns to executive levels in European businesses demonstrates that privacy adaptation requires significant organizational change. This insight can help organizations in other regions prepare, not just with technical solutions, but with appropriate governance structures and executive engagement.

The European business response to privacy regulation that this survey reveals isn’t just a regional curiosity. It’s a preview of the future for organizations worldwide. It offers both cautionary lessons and strategic inspirations for navigating an increasingly privacy-conscious business environment.

Company size driving the evolution of privacy management

The management approaches revealed in the survey, i.e. the split between in-house (56 percent) and hybrid management (44 percent), also suggest that we’re moving toward a future where privacy management will become a core business function, in a way similar to how digital marketing evolved.

Organizations initially outsourced digital marketing entirely, then gradually built internal capabilities while maintaining external partnerships for specialized needs. The preference for in-house privacy management among small businesses reflects both their resource constraints and need for direct control. Unlike large enterprises, smaller organizations will often manage data privacy with minimal outsourcing.

The company size distribution in the survey helps us understand how this future might unfold differently across organizations. Small businesses, which made up 47 percent of respondents, will likely drive innovation in simplified privacy solutions. Larger organizations, with more resources but also more complex needs, will probably lead in developing comprehensive privacy compliance frameworks that smaller organizations can later adapt.

The mid-sized companies (51-250 employees) show an interesting pattern. They’re more likely to use a hybrid approach of both in-house and agency support. This makes sense when we consider that they’re large enough to have complex privacy needs but might not yet have the resources to build comprehensive in-house privacy teams.

They’re in what we might call the “complexity sweet spot,” large enough to need sophisticated privacy management, but not so large that they can easily build, maintain, and upgrade it all internally.

Large enterprises (251+ employees) show yet another pattern. With their greater resources, they’re more likely to have dedicated privacy teams and sophisticated internal processes.

However, they also face more complex challenges due to their scale, with more data, more customer interactions, and more jurisdictions to consider. Therefore, many still opt for hybrid approaches, combining internal expertise with external specialized support.

This analysis helps us understand why one-size-fits-all approaches to privacy compliance often fall short. A small business owner personally managing their website’s cookie banner has very different needs and capabilities compared to a large enterprise with multiple websites (and potentially apps and other connected platforms) across several jurisdictions. Still, both need to meet similar compliance standards.

Future trends in data privacy management

These patterns suggest several key trends for the future.

- Privacy as a brand differentiator: The high level of executive involvement suggests privacy will become a key brand value proposition, similar to how sustainability has become a core business message.

- Technological integration: The challenges reported in implementation point to a future where privacy controls are deeply embedded in marketing technology, rather than being add-on features.

- Skill evolution: The identified need for better understanding and training suggests that new roles and skills will emerge, and may lead to positions like Privacy Marketing Specialist or Consent Optimization Manager.

- Market segmentation: The varying approaches based on company size suggest a future market of privacy solutions segmented by organization scale and complexity, rather than one-size-fits-all solutions.

- Cultural shift: The shift toward explicit consent and user control indicates a broader shift in how organizations view their relationship with customer data.

To understand where the industry is heading, it’s helpful to think about how other branches of digital marketing evolved. For instance, email marketing began with few restrictions, went through a period of increasing regulation, and eventually emerged with new best practices that balanced marketing effectiveness with user rights. Privacy-Led Marketing now gives indications of being on a similar journey, with even broader implications.

About the research

The research was conducted by Sapio on behalf of Usercentrics in December 2024 and is based on interviews with 600 respondents (of those, 150 were in the UK/Germany/Spain/Italy) who have decision-making power over their company’s website and consent banners, including legal and compliance roles, web developers/owners and senior marketing decision-makers from all company sizes, as well as owners, C-level executives, and directors from small businesses.