Consumers’ trust has always been conditional, not automatic. But in the past it was also easier for companies to present as authoritative and trustworthy when consumers had less access to information — regardless of what a company or industry was doing behind the scenes.

Consumer manipulation is nothing new. For example, while many people may not know the term “dark patterns,” they have definitely experienced them in action. How often do we have to hunt for links, follow labyrinthine or misleading instructions, or end up frustrated when we just want to unsubscribe from emails, cancel a service, or decline unwanted ads?

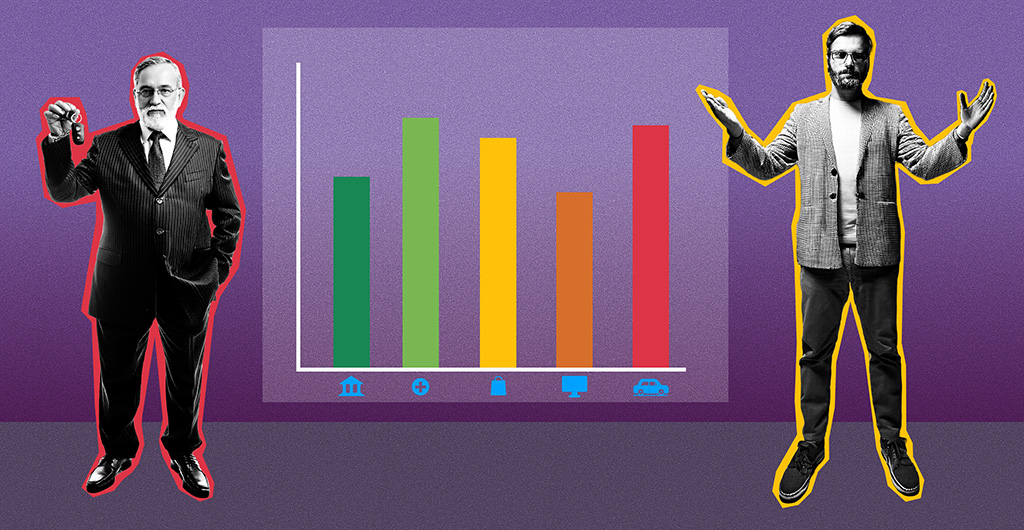

Usercentrics research published in the 2025 State of Digital Trust Report revealed that today, industries like banking and healthcare remain more trusted (at 57 and 49 percent, respectively). For other industries like retail and automotive, however, gaining and maintaining consumer trust is an ongoing struggle. (Automotive comes in last at a weak 13 percent.)

The research also shows that high trust is built by specific actions, not by magic or manipulation. That’s good news, as it means even brands in low-trust industries can change consumer perceptions and build long-term trust.

No company or industry can automatically assume they’ll always have consumers’ trust. Whether your company is in finance or travel, here’s what bolsters or breaks down trust, where you may be falling short, and the concrete actions you can take to (re)build it long term.

The data on trust

What do consumers want? Expectations often seem to evolve so quickly that it’s hard for companies to keep up if they want to retain — let alone grow — their customer base.

Let’s take tech as an example. In its annual Trust Barometer report for 2025, Edelman found that 76 percent of consumers surveyed around the world trust businesses in the technology industry. That number was consistent with the previous year. Tech is a thoroughly ingrained part of our lives, so the number isn’t terribly surprising.

At the same time, as the Trust Barometer report also revealed, fewer than half of consumers polled (48 percent) trust social media companies to do what’s right, and only 42 percent of respondents trust them for news and information — down 44 percent from the previous year.

Norms are shifting and trust isn’t consistent across or even within industries, so what are companies to do?

Why banking, government, and healthcare still lead on trust

More highly trusted industries, which include banking/finance, government and the public sector, and healthcare and pharma, share three defining traits.

Defining traits for high-trust platforms

Operate under visible constraints

Communicate clearer expectations around how data is accessed and used

Demonstrate a long-standing track record of aligning data collection with outcomes that people directly benefit from

Trust in these sectors isn’t driven by slick marketing, consumers’ affection, or brand loyalty, but by predictability. People understand the rules, the risks, and the recourse when something goes wrong.

Regulatory oversight creates perceived accountability

In banking, healthcare, and the public sector, consumers expect scrutiny. These industries are heavily regulated, with oversight bodies that carry real authority.

Audits, penalties, and enforcement create the sense that someone is watching. Regulation doesn’t automatically make organizations trustworthy, but it does introduce perceived accountability, and that reduces uncertainty.

Ask yourself, do you love your bank? Maybe not, but you probably trust the rules that govern it.It’s also no coincidence that the personal data these sectors handle is often explicitly defined in privacy laws as “sensitive.” Because misuse of sensitive types of personal data can cause disproportionate harm to data subjects, this data is subject to stricter requirements and significantly higher penalties when those requirements aren’t met.

Clear limits reduce ambiguity

In sectors like banking and healthcare, the boundaries around data use are clearer. You expect your bank to use your data to process transactions and prevent fraud, and your doctor to use it to provide care. The purpose is straightforward, even if the systems behind it are complex.

When people understand the “why,” they’re more willing to accept the process and stay engaged. Trust is built not in the abstract, but in the details — from how a privacy policy is worded to how consent choices are presented on a cookie banner.

Data use aligns with consumer benefit

In more trusted industries, the value exchange between data access and consumer benefit feels proportionate. Data collection maps directly to outcomes people care about, including security, health, and access to essential services.

That alignment has been reinforced over decades, something “younger” industries like tech can’t rely on. But now it isn’t guaranteed for anyone.

Expectations are shifting, scrutiny is rising, and with ongoing disruption even in the most stalwart industries, past trust alone won’t carry companies forward.

Why industries like tech, retail, and automotive lag behind

Lower-trust industries tend to share a common profile.

Defining traits for low-trust industries

Fewer visible constraints

More opaque data flows

Weaker perceived link between data collection and clear consumer benefit

Many of these sectors also pride themselves on speed and disruption, on “moving fast” and challenging established norms. The problem is that what has too often been disrupted isn’t just markets, but regulatory boundaries, data security, and consumer trust itself.

Trust erodes here not because people oppose innovation, but because the rules feel unclear, the risks uneven, and the value exchange opaque. Past behavior has trained consumers to approach these brands with caution by default.

And while big tech and social platforms are deeply embedded in everyday life, that ubiquity hasn’t translated into trust. To date, five of the ten highest GDPR fines have been levied against Meta, the parent company of Facebook, Instagram, WhatsApp, and related platforms.

Complexity without visibility

Before the internet, data relationships were comparatively simple. You provided most of the information companies needed directly, and what they could infer, aggregate, or share was limited.

That changed quickly. Digital platforms made it possible to track not just what people bought, but also how they browsed, compared, hesitated, and decided — often invisibly and at scale.

Today, people are far more aware of that reality and increasingly unwilling to accept it without clear benefit. This is especially true for Gen Z. They’re open to transactional relationships, but only when the value exchange is explicit and fair.

Opacity, by contrast, breeds suspicion. When value isn’t clearly returned, questions about manipulation or predatory behavior take hold. And once trust erodes, it rarely does so quietly or temporarily.

Gen Z is becoming the largest consumer segment. Learn what they want from brands in our new report: Winning Gen Z: A Marketer’s Guide to Digital Trust.

Vague value exchanges

Retailers and platforms often promise “personalization” without explaining what that actually delivers for the individual. At the same time, many fail to communicate clearly what personalization requires, even as they’ve already persuaded customers that it’s desirable.

For a long time, particularly online, companies could operate with minimal constraint. Consent wasn’t required, data practices went largely unexplained, and providing clear user benefit wasn’t expected. It’s unsurprising that an extractive mindset took root in that environment.

But trust erodes when benefits remain abstract amid constant data requests. People don’t object to data use itself. They object to unclear requirements, opaque trade-offs, and value exchanges that feel one-sided.

Scandals and saturation

In data privacy, scale makes headlines. Billion-dollar fines and breaches affecting hundreds of millions of people dominate the news. But the volume and repetition of these incidents, often involving the same companies, has made them blur together.

The cumulative effect is persistent unease. Across industries, repeated stories of breaches, misuse, and regulatory action (or the lack of it) have trained consumers to be cautious by default, even toward well-regulated sectors and brands with genuinely ethical intentions.

Trust isn’t built in isolation. It’s shaped by collective memory and collective behavior. Which means that even companies following best practices must go further: reinforcing trust consistently, across touchpoints, and over time, to counteract the weight of negative external experiences.

Industry labels matter less than trust drivers

Despite wide variation across sectors, and despite shifting expectations, technologies, and laws, consumers are strikingly consistent about what builds trust.

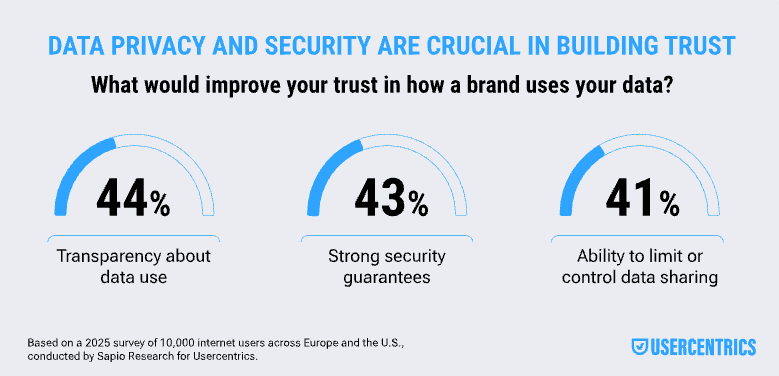

The State of Digital Trust Report makes that clear. 44 percent of those surveyed said transparency about how data is used is the single most important factor, followed closely by strong security guarantees (43 percent) and the ability to control or limit data sharing (41 percent).

The implication is uncomfortable but simple: trust isn’t determined by the industry you’re in. It’s shaped by how consistently (and too often, how rarely) these expectations are fully met.

If you’re looking to improve your trust positioning, here are some tips.

Transparency needs to be immediate and human

People want to know what data is collected and why. Even for early-stage companies without dedicated legal teams, this isn’t an unreasonable bar.

What is required is a clear, plain-language explanation at the moment data is requested, not information buried in dense terms, or written for lawyers or software developers.

Visibility builds confidence. It signals that nothing is being hidden. Delay does the opposite. Making people search for data-use details or consent controls isn’t neutral friction — it actively undermines trust.

Control must be real, not symbolic

“All or nothing” consent choices signal convenience for companies, not respect for users. Consumers consistently favor granular options and the ability to manage preferences over time.

This preference is increasingly reflected in privacy regulations, which require choices to be clear, equal, accessible, and revocable. Manipulative practices are increasingly prohibited by authorities.

In that vein, declining consent shouldn’t (and according to some regulations, can’t) result in degraded access or punitive design.

Gen Z’s insistence upon fair value exchange is spreading, alongside growing rejection of manipulation, coercion, and extractive relationships.

Security must be demonstrated, not declared

Generic claims about robust security or “putting customers first” no longer reassure anyone. People have seen too many breach notifications, often delivered late, and often compounding the damage to brand trust.

Reassurance comes from behavior, not slogans. Timely communication, clearly articulated safeguards, and fast, accountable response matter most — especially when things go wrong.

People understand that failures can happen. What they judge is whether you were prepared, transparent, and serious about your response.

What brands in low-trust industries can do differently

Just as no company or industry is guaranteed to retain consumer trust, the reverse is also true.

Trust can be rebuilt. It isn’t about a single growth hack or a compliance checklist; it’s about working on your customer relationships.

The type of work that’s granular, ongoing, and operational — not something only reserved for crisis communications.

What you can do:

Lead with explanation, not obligation

Explain the benefit before requesting consent. Answer the consumer’s question about “What’s in it for me?” clearly and early, and be explicit about what data you use and why.

Design consent as a brand moment

Consent touchpoints shape first impressions. Treat them as opportunities to communicate values and build relationships, not as boxes to tick.

Offer real choice without pressure or manipulation

Declining, withdrawing, or updating consent should be as easy as accepting it. When you are doing it right, your data collection defaults are respectful, your granularity is standard, and your best practices go beyond legal minimums.

Practice restraint

Collect less data, with more intention. Signal to consumers that trust matters more than volume, and that every data point collected is necessary and valued. Restraint builds credibility, and data minimization is increasingly a regulatory expectation.

Trust is a competitive differentiator

Markets are more crowded than ever. Even long-established industries are changing quickly.

Consumers have more choice, and more information, than ever before.

Here’s what you should know: Trust compounds over time. It shapes loyalty, advocacy, data quality, and long-term revenue. But it can’t be assumed or inherited; it has to be earned continuously.

No industry is fixed in its trust position. Every sector can improve, or fall. Consumers’ expectations are changing, and companies need to change with them to remain sustainable and competitive.

Ultimately, the strongest companies don’t chase trust rankings. They focus on treating customers with respect and delivering consistently good experiences — from product design to privacy practices.

Learn how privacy by design can support sustainable growth.