Regulatory requirements no longer sit neatly inside one department. Privacy, security, financial controls, and industry-specific regulations now affect how products are built, how data is handled, and how teams report their work. As a result, compliance has become an operational responsibility rather than a standalone legal task.

This is where a regulatory compliance platform becomes essential. Instead of relying on spreadsheets, email threads, and disconnected point solutions, companies can use a centralized regulatory compliance system. This enables you to track obligations, manage evidence, and demonstrate compliance at any time.

In this guide, we break down the leading regulatory compliance platforms for 2026, how they differ, their pricing, and how to choose the right one.

At a glance

- Regulatory compliance platforms centralize compliance management, reducing manual work and minimizing human error.

- Choosing the right platform depends on your compliance requirements, organizational size, budget, and integration needs.

- Pricing varies significantly, from affordable entry-level options to enterprise solutions, though some regulatory software solutions offer free trials.

- Consider whether you need specialized features like automated evidence collection, risk management, or multi-framework support.

- Implementation time and ease of use matter as much as features when selecting a solution.

Why regulatory compliance tools are essential in 2026

Compliance used to be something you handled once a year during audit season. That approach no longer works. Regulations now evolve faster than internal processes can keep up, and the consequences of missing requirements have become more expensive and public.

The shift isn’t just about risk. It’s about how teams actually work. Legal can’t track every obligation alone. Engineering needs to know what controls apply to new features. Marketing needs visibility into what data can be used. Customer Success needs answers when users ask how their data is handled.

Without a regulatory compliance platform, this information lives in disconnected places: policy documents, Slack threads, ticketing systems, and someone’s memory. When an auditor asks for proof of compliance, teams scramble to reconstruct evidence that should have been captured automatically.

A regulatory compliance system changes this by connecting obligations to the people responsible for them. Capture evidence as work happens and make compliance status visible to everyone who needs it. This turns compliance from a periodic audit exercise into something that runs continuously in the background.

Key features to look for in regulatory compliance software

Most regulatory compliance software vendors offer a core set of features, but not all regulatory tools serve the same purpose. The right platform for your business depends on whether your biggest risk lies in privacy, security, finance, or operational governance.

Across categories, strong regulatory compliance systems typically include:

- Centralized policy and control management

- Automated evidence collection

- Risk and issue tracking

- Regulatory mapping across frameworks

- Workflow automation for reviews and approvals

- Audit logs and version history

- Executive reporting dashboards

Most tools offer these features as a core part of their offering. However, their pricing, positioning, and add-ons can vary per industry and company size.

Top 8 regulatory compliance platforms in 2026

Regulatory compliance doesn’t have to feel overwhelming. The right regulatory tracking software helps you move beyond reactive scrambling to a clear, confident compliance strategy that serves both your organization and your customers.

Usercentrics

Usercentrics CMP is a leading consent management platform (CMP) and data privacy solution that enables businesses to collect, manage, securely store, and signal user consent in line with major data privacy regulations like the General Data Protection Regulation (GDPR), California Consumer Privacy Act (CCPA), and Brazil’s Lei Geral de Proteção de Dados (LGPD).

Where many compliance platforms focus on internal IT and security, Usercentrics specializes in helping businesses navigate the complexities of consent and data privacy compliance without sacrificing marketing and revenue performance.

Key features

- Data privacy audit: Scan your website for tracking cookies and related technologies to understand your compliance risk level with data collection for relevant privacy regulations.

- Centralization and security: Securely store and centralize consent records, making it easier to pull evidence for audits or Data Subject Access Requests (DSARs).

- Smart data protector: Prevent third-party tools from collecting user data unless explicit consent has been given.

- Geolocation: Automatically detect the user’s location to present the correct, regionally accurate consent banners in the preferred language.

- Detailed analytics and reporting: Gain insights on user interactions and consent rates to drive your optimization strategy.

Pricing

- Free 14-day trial

- Pricing starts at EUR 7/month for 1,500 sessions

- Pricing goes up to EUR 50/month for Business plans

- Enterprise pricing is based on custom requirements

| Pros | Cons |

| User-friendly implementation | Essential and Plus plans are limited to one domain |

| Strong audit-ready record keeping and centralized consent | The Essential plan limited to a single regulation |

| 60+ supported languages | |

| Automated blocking of non-essential services |

Sprinto

Sprinto is a compliance automation platform built to help cloud-first and SaaS companies tackle security certification quickly and with confidence. The company recognizes that manual audits are slow and outdated, which is why their system focuses on full automation.

Sprinto integrates directly with your cloud tools to monitor controls in real time and continuously collect audit evidence. This enables businesses to achieve certifications like SOC 2 and ISO 27001 with less frustration and faster turnaround.

Key features

- Continuous monitoring and automated checks: Integrates with over 200 cloud services to monitor security controls in real time and automatically flag misconfigurations.

- Automated evidence collection: Continuously collects audit-friendly evidence and organizes it by control, centralizing documentation and eliminating the last-minute scramble.

- Integrated risk management: Includes tools for conducting risk assessments, mapping risks to controls, and managing a risk register.

- Multi-framework support: Supports more than 20 compliance frameworks, enabling you to map and monitor controls across multiple standards.

Pricing

- Sprinto’s website does not disclose pricing. Interested parties need to request a demo to know more.

| Pros | Cons |

| Supports over 20 frameworks, including SOC 2 and ISO 27001 | No transparent pricing |

| Purpose-built for cloud-first and SaaS companies | Not built for enterprise-level complexity |

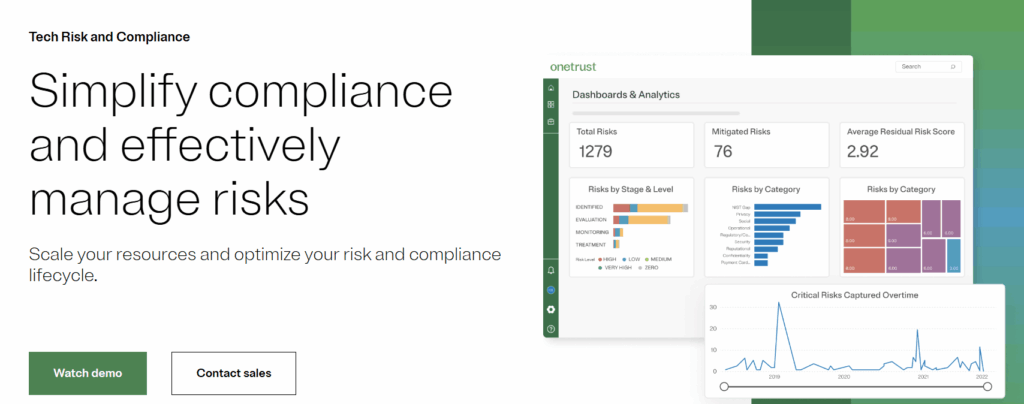

OneTrust GRC

OneTrust is an integrated Governance, Risk, and Compliance (GRC) platform dedicated to helping large organizations measure, manage, and demonstrate trust.

They aim to solve the problem of repetitive audits through their proprietary Shared Evidence Framework. This unique system allows you to collect evidence once and apply it across 50+ global standards and regulations, saving significant time and resources.

Key features

- Proprietary shared evidence framework: Allows the collection of evidence once and the use of that data to comply with multiple frameworks.

- Support for more than 50 frameworks: Provides out-of-the-box content, controls, and templates for a wide range of regulations, including SOC 2, ISO 27001, GDPR, and HIPAA.

- Automated compliance workflows: Moves teams from research to action with automated evidence collection and clear implementation guidance.

- AI governance: Includes solutions to embed compliance and control across the AI lifecycle.

Pricing

- OneTrust’s website does not disclose pricing. Interested parties need to request a demo to know more.

| Pros | Cons |

| GRC management for multiple privacy laws | No transparent pricing |

| Automated compliance assessments | It’s been noted to have a steep learning curve and can be complex to operate, which might be a disadvantage for some users. |

| Extensive feature set |

IBM OpenPages

IBM OpenPages is built for enterprises that need to manage GRC across multiple business units, geographies, and regulatory frameworks simultaneously. It uses AI from IBM watsonx to surface risks and automate workflows across ten different GRC functions in one platform, which helps large organizations avoid the siloed risk management that creates blind spots.

Key features

- AI-powered virtual assistant: Get 24/7 support with a GRC virtual assistant that provides real-time answers and promotes accuracy in incident reporting with AI-suggested classifications.

- Task-focused UI: Modern interface enables minimal training for users.

- GRC embedded workflows: Run workflows on a scheduled basis, on demand, or upon object creation with drag-and-drop functionality for easy customization.

- Single data repository: Standardized libraries, comprehensive REST APIs, and a single data model ensure consistent views of risk and compliance across unlimited hierarchies.

Pricing

- The Essentials plan starts at USD 3,300/month

- On-cloud plans start at USD 6,250/month

- On-premises solutions require interested parties to reach out to get a custom quote

| Pros | Cons |

| AI-driven analytics and automation capabilities | Steep learning curve for implementation |

| Highly scalable for enterprises with tens of thousands of users | Customization often requires IBM services or external consulting |

| Recognized as a Leader in the 2025 Gartner Magic Quadrant for GRC Tools |

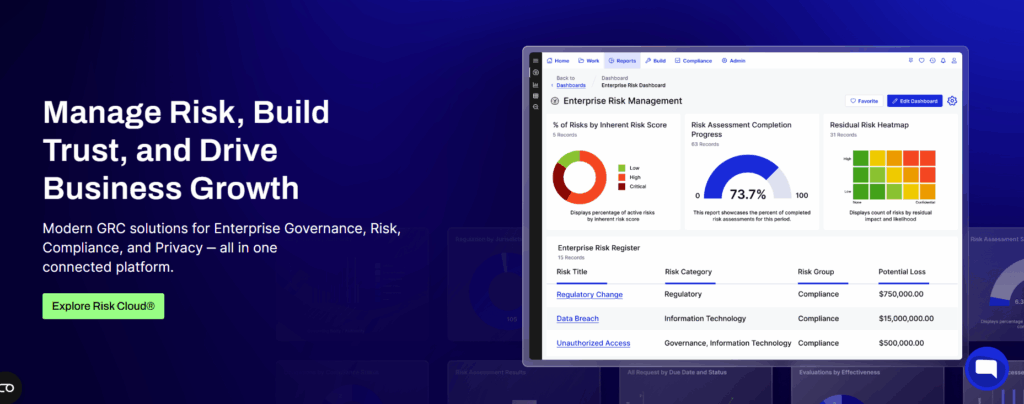

LogicGate

LogicGate takes a no-code approach to GRC, which means compliance teams can build and modify workflows without waiting for development resources. What sets it apart is the focus on risk quantification using Monte Carlo simulations and the Open FAIR model. This turns compliance risks into financial figures that CFOs and boards actually understand.

Key features

- No-code workflow builder: Design end-to-end processes using visual tools without writing code, enabling quick adaptation to changing requirements.

- Risk cloud control repository: Connect internal controls and frameworks to identify gaps and overlaps across compliance regulations.

- Automated control testing: Assign tests, collect evidence, and track remediation through automated workflows with clear task ownership.

- FAIR-focused risk analysis: Quantify financial impact of risks using Monte Carlo simulations and the Open FAIR model for board-level decision-making.

Pricing

- LogicGate’s website does not disclose pricing. Interested parties need to request a demo to know more.

| Pros | Cons |

| Outstanding customer support with responsive teams according to G2 reviews | No transparent pricing |

| Highly customizable to specific workflows | Steep learning curve for administrators setting up the system |

| Named a Leader by G2 for 25 consecutive quarters |

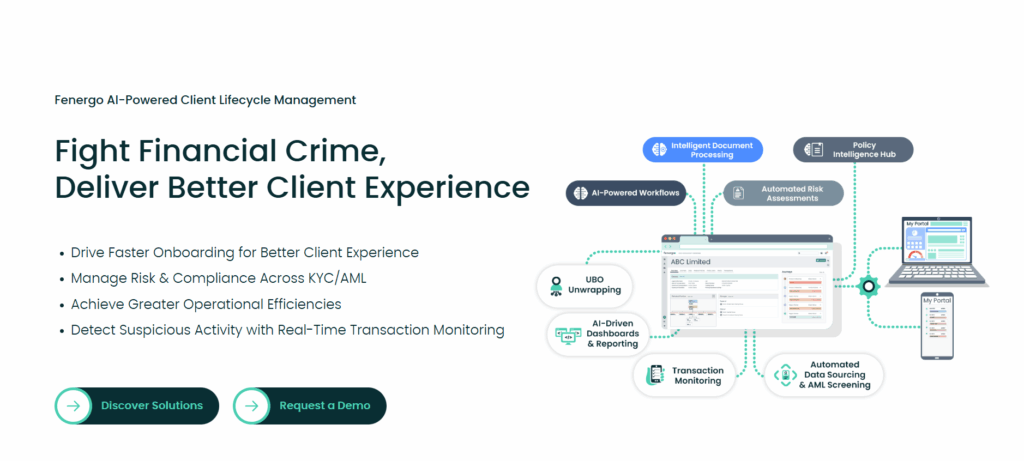

Fenergo

Fenergo is a client lifecycle management platform designed specifically for financial services. It handles KYC, AML, transaction monitoring, and the regulatory requirements that banks and asset managers face.

The platform recently added six AI agents that automate tasks like data sourcing and document management, which addresses the volume problem that financial institutions deal with during client onboarding.

Key features

- Client lifecycle management: Automate onboarding journeys including KYC, risk assessment, and PEP/sanctions screening for financial services clients.

- Regulatory compliance: Pre-packaged workflows and rules for global and local regulatory frameworks including Tax, ESG, and Investor Protection.

- Transaction monitoring: Real-time detection engine to identify suspicious activity and reduce false positives in AML compliance.

- Agentic AI capabilities: Six AI agents automate tasks including data sourcing, screening, document management, and insights generation.

Pricing

- Pricing information isn’t available. Interested parties need to contact Fenergo directly for custom pricing information.

| Pros | Cons |

| Specialized for financial services with deep regulatory expertise | No transparent pricing |

| AI-powered automation capabilities | Primarily focused on financial services sector |

AuditBoard

AuditBoard connects audit, risk, and compliance functions into one platform with a unified data core. It’s designed to reduce manual work through AI that can generate control narratives and risk summaries. The platform also integrates with more than 200 tools, which means evidence collection happens automatically rather than through spreadsheet exports.

Key features

- AuditBoard AI: Automate workflows and receive intelligent recommendations to generate control narratives, risk summaries, and assessment reports with minimal manual input.

- Microsoft 365 integration: Connect with Microsoft programs to streamline document creation and updates across your compliance operations.

- Automated issue management: Gain real-time visibility into open issues and track progress toward resolution with connected workflows.

- 200+ integrations: Connect with tools like Jira, Snowflake, and ServiceNow to automate evidence collection across your tech stack.

Pricing

- Pricing information isn’t available. Interested parties need to contact AuditBoard directly for custom pricing information.

| Pros | Cons |

| Intuitive to use with minimal training required | No transparent pricing |

| Strong integration ecosystem with 200+ tools | Cloud/browser-based only, no on-premises option |

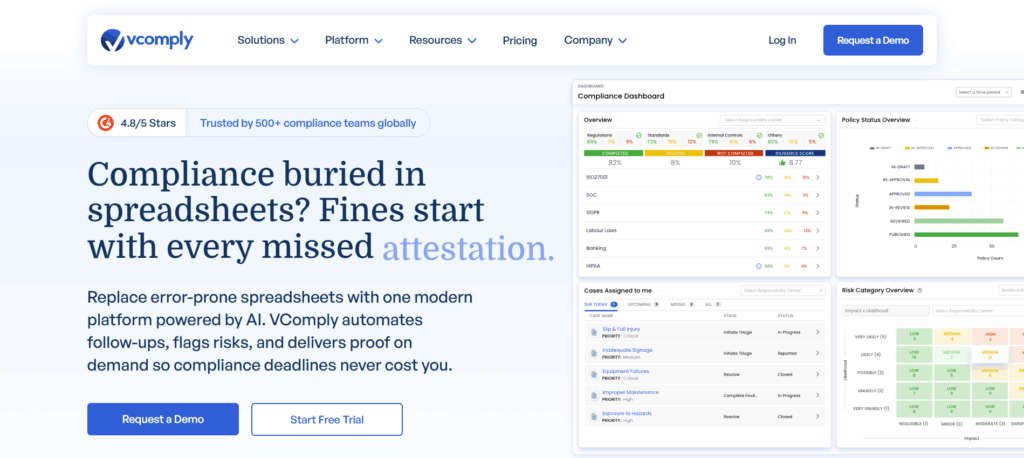

VComply

VComply is built on an Entrust, Verify, Analyze, and Sustain framework that organizes compliance around task management and scheduled activities. It includes features like a compliance calendar with automated reminders and a CAL repository for tracking certificate renewals.

Key features

- Audit workroom: Track and record audit-related events for verification purposes with collaborative cloud-based document management.

- Compliance calendar: Plan and schedule audit activities with automated reminders for pending tasks and escalating alerts for overdue compliance.

- Risk management module: Classify compliance tasks based on risk level to prioritize responsibilities and generate separate risk analysis reports.

- CAL repository: Store certificates, licenses, and agreements with automatic renewal notifications to ensure timely action.

Pricing

- Free trial available

- The most popular pro option starts at USD 1,000/month

- Startups and enterprise companies need to contact VComply for custom pricing

| Pros | Cons |

| Free trial | Time-consuming to set up, according to G2 user reviews |

| User-friendly interface that reduces training needs | Limited integrations with existing systems |

| All-in-one compliance, risk, audit, and policy management |

How to choose the right compliance software solution for your business

To choose the right regulatory compliance platform, start with how your organization actually operates and where your regulatory exposure sits. Here are a few strategies:

- If your primary risk sits in personal data, cookies, and user tracking, prioritize a privacy-focused regulatory compliance tool that supports consent, user rights, and data protection laws.

- If you operate across multiple regions, look for regulatory software solutions that support several frameworks and provide clear regulatory mapping.

- If your main exposure is security audits, choose regulatory compliance systems with continuous evidence collection and infrastructure integrations.

- If your organization runs structured audit programs, focus on regulatory compliance software vendors that support internal audit workflows and reporting.

- If multiple teams share ownership, ease of use, guided workflows, and clear task ownership matter more than deep customization.

- If reporting and accountability are critical, prioritize regulatory tools with strong audit trails, issue tracking, and executive dashboards.

The best regulatory compliance system is not the one with the most features. It’s the one that matches where your compliance bottleneck is.

Invest in regulatory compliance in 2026 to keep up with data privacy laws

Choosing a regulatory compliance platform is no longer just about passing the next audit. It’s about building a system that keeps pace with changing laws and a company’s growing data use. The right platform turns compliance from a reactive process into a proactive one. Where evidence is ready, and teams know what needs to happen next.

Whether you need specialized consent management, like Usercentrics provides, rapid certification support like Sprinto’s, or enterprise-grade capabilities like those from IBM OpenPages and AuditBoard, the right regulatory compliance platform makes compliance manageable rather than overwhelming.