Managing regulatory compliance manually isn’t just time-consuming, it can also be risky. With data privacy laws, security frameworks, and continuously evolving industry-specific mandates, staying compliant requires more than just checklists and spreadsheets.

Automated regulatory compliance software can help you to stay ahead of audits, avoid fines, and reduce the burden compliance places on your team. But you’ll need the right software for the job at hand.

In this guide, we’ll walk you through some of the top automated compliance tools on the market, whether you need a data privacy compliance solution, a financial reporting platform, or robust IT security.

Our top picks for automated regulatory compliance software:

| Automated regulatory compliance tool | Core function | Key features | Usability score |

| Usercentrics | Data privacy compliance | Granular customization optionsAutomated cookie scanningA/B testing and analytics | 4.4 |

| Thoropass | Security compliance | First Pass AIRisk RegisterFramework-specific policy templates | 4.0 |

| iDenfy | Fraud prevention and compliance | High-accuracy ID and biometric checksRisk-scoring and sanctions screeningKYB company verification | 4.4 |

| Workiva | Automated reporting and audits | Unified reportingWorkiva AIExtensive partner network | 4.4 |

| Fenergo | Financial compliance | Hybrid AML transaction monitoringAgentic AINo-code configuration | Not available |

| RegEd | Compliance and regulatory training | Policy and procedure managementSmart DisclosuresTraining tracking | Not available |

| Drata | Multi-regulation compliance | AI-Native trust managementContinuous control monitoringAutomated evidence collection | 4.7 |

| Laserfiche | Information governance | Laserfiche AISmartFields extractionSolution templates | 4.3 |

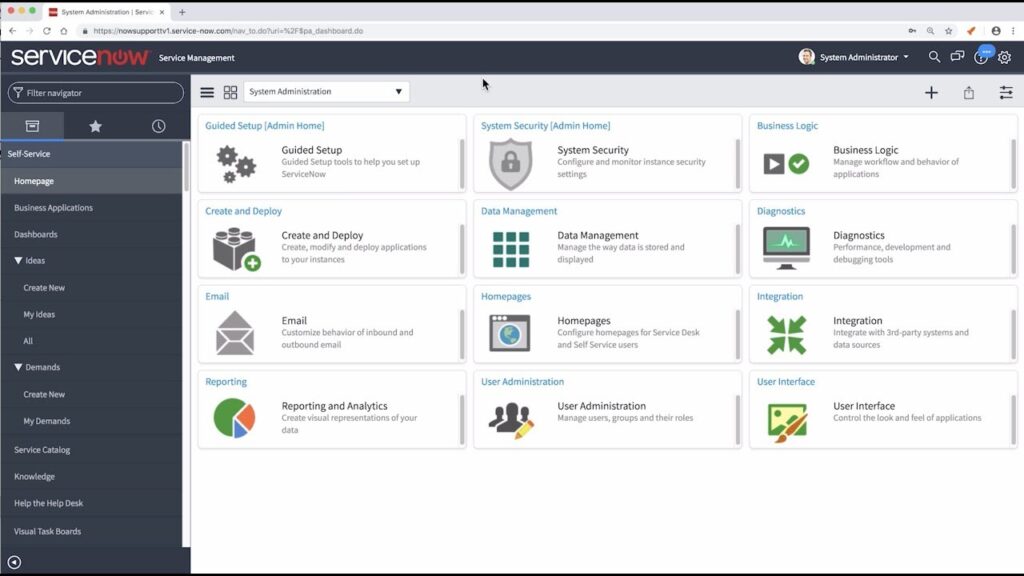

| ServiceNow | AI-powered risk management | AI risk agentsPredictive analyticsNow Assist | 4.2 |

| Scrut Automation | All-in-one GRC platform | SmartGCR automationTrust VaultPre-built policy library | 4.9 |

How do you automate regulatory compliance?

To automate your regulatory compliance, you’ll need to leverage compliance management software to handle repetitive, data-heavy tasks.

These systems automate document generation, policy rollouts, evidence collection, and risk analysis, which can cut the time you spend on compliance from days to hours and reduce your reliance on spreadsheets and manual checklists.

Thanks to integrations with HR systems, cloud platforms, and security tools, automated compliance tools can continuously monitor your compliance controls and map them to requirements of the General Data Protection Regulation (GDPR), the California Consumer Privacy Act (CCPA), SOC 2, PCI, and other important frameworks.

“Using a tool for regulatory compliance automation helps companies stay up to date and protected in ever-evolving legal and regulatory landscapes and in digital markets,” says Eike Paulat, Director of Product at Usercentrics.

Paulat notes that “It helps free up internal resources and reduces noncompliance risks from human error, outdated information, or gaps in addressing privacy compliance requirements. It also helps meet partner platforms’ requirements and deliver peace of mind so teams can focus on core business goals.”

The real value of compliance automation is in continuous oversight and proactive issue detection. With centralized dashboards and detailed audit logs, organizations can produce on-demand reports for internal audits or regulatory bodies, saving both time and money.

That means you and your team can prioritize strategic tasks over compliance busywork, freeing you up to focus on growth, product improvement, and building lasting customer relationships.

10 top automated regulatory compliance software for unique business needs

With regulations tightening and customer expectations rising, automated compliance software gives businesses the tools they need to stay ahead without draining internal resources. Below are some of the best tools for managing data privacy to reduce risk, streamline workflows, and build a more resilient compliance program.

1. Usercentrics for data privacy compliance

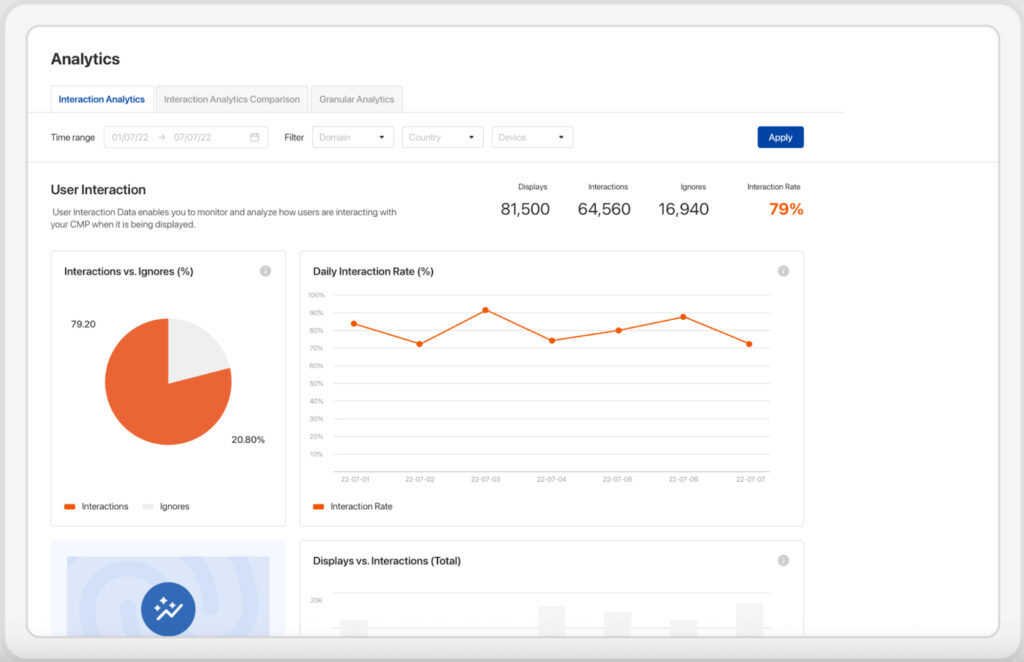

Usercentrics offers leading data privacy compliance software that enables businesses to automate and manage user consent across multiple domains and devices.

It supports organizations’ efforts to comply with major data privacy laws and frameworks, including the GDPR, CCPA, and the Transparency & Consent Framework (TCF). It also offers customizable banners, multi-language support, and more than 2,200 legal templates.

Designed for marketers, technical teams, and privacy professionals, it uses intuitive drag-and-drop builders, mobile software development kits (SDKs), and Application Programming Interfaces (APIs) to simplify implementation and customization.

Plus, features like A/B testing, customizable reporting, and detailed analytics empower teams to fine-tune consent strategies to optimize opt-in rates.

Beyond helping businesses achieve and maintain privacy compliance, Usercentrics is a lever for building trust and lasting relationships with users. The tool balances these factors with marketing performance, helping businesses obtain high quality data and grow both customer engagement and revenue.

“We chose Usercentrics for its ability to provide harmonized compliance and marketing,” says Alix Courdier, Head of Marketing Tech at Lipton Teas and Infusions. “Since implementing the CMP, [we] have experienced better compliance with data privacy regulations, improved user trust, and enhanced marketing capabilities.”

Key features

- Granular customization options: Enables you to create consent banners that are fully brand aligned and optimize consent rates.

- Automated cookie scanning: Identifies trackers across your web, app, and connected TV (CTV) platforms and can automatically block them until you obtain user consent.

- API and SDK support: Robust REST APIs and mobile SDKs enable seamless integration into your existing tech stack.

- Consent audit trail: Providesdetailed logs to monitor consent changes and maintain accuracy in compliance reporting.

- A/B testing and analytics: Empowers teams to test strategies and gain insights at a glance with the help of visual reports.

Pricing plans

- Free trial: 14 days (no credit card required)

- Essential: USD 8/month for up to 1,500 sessions on one domain with one regulation

- Plus: USD 16/month for up to 3,000 sessions on one domain with unlimited regulations

- Pro: USD 34/month for up to 15,000 sessions on three domains with unlimited regulations

- Business: Scalable pricing from USD 56/month for up to 50,000 sessions on ten domains with unlimited regulations

| Pros | Con |

| Multi-regulation data privacy compliance with built-in Server-Side Tracking tools | Analytics data only available for 90 days |

| Geolocation functionality and display notices in 60+ languages | |

| Unified interface for configuring web and app consent management |

2. Thoropass for IT and security compliance

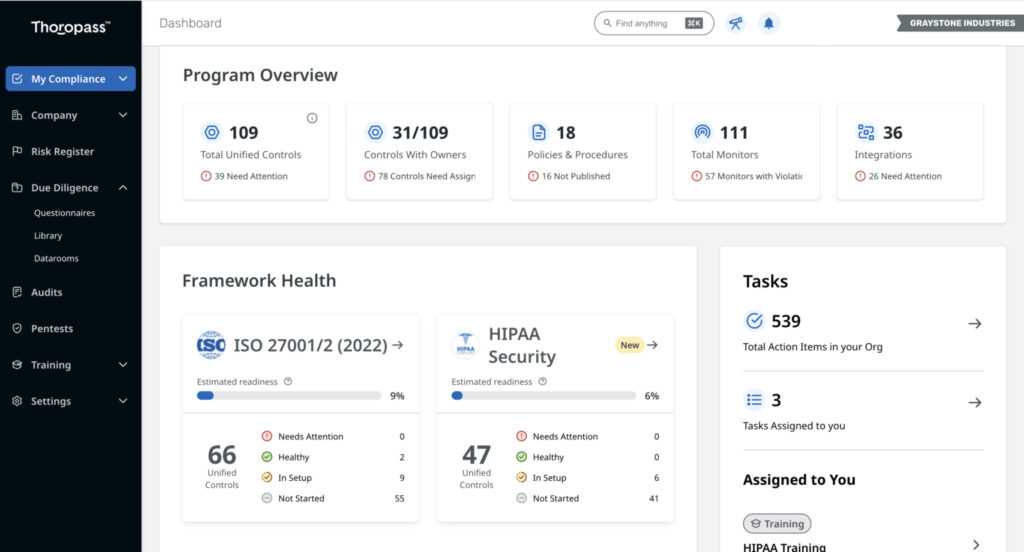

Thoropass combines audit assessment with compliance automation by giving users access to compliance automation tools and expert auditors in one platform.

Covering frameworks like System and Organization Controls (SOC) 2, the payment card industry (PCI), and the International Standard on information security management (ISO) 27001, it’s a strong fit for businesses that need to focus on IT compliance and infosec assessments.

By centralizing task tracking, documentation, and auditor communication, Thoropass creates a friction-free, audit-ready environment and reduces reliance on spreadsheets and email chains.

It also streamlines evidence collection by providing more than 100 integrations, including Amazon Web Services, Google Workspace, and Jira.

Key features

- First Pass AI: Checks evidence for completeness, consistency, and timeliness to reduce audit loops and shorten audit cycles.

- Risk Register: Discovers, tracks, and minimizes risks with a streamlined risk management workflow.

- Trusted auditors: Offers access to in-house auditors to design a compliance program that meets your unique business needs.

- Framework-specific policy templates: Creates compliant, audit-ready policies aligned with relevant regulations.

- Pen testing: Identifies and fixes vulnerabilities to strengthen your security posture and get you compliance-ready.

Pricing plans

Thoropass pricing is based on business requirements. Organizations need to contact the company for details.

| Pros | Con |

| Audit-in-platform functionality | Lack of clarity around pricing |

| 100+ integrations | |

| Helpful customer support, according to G2 users |

3. iDenfy for fraud prevention and compliance

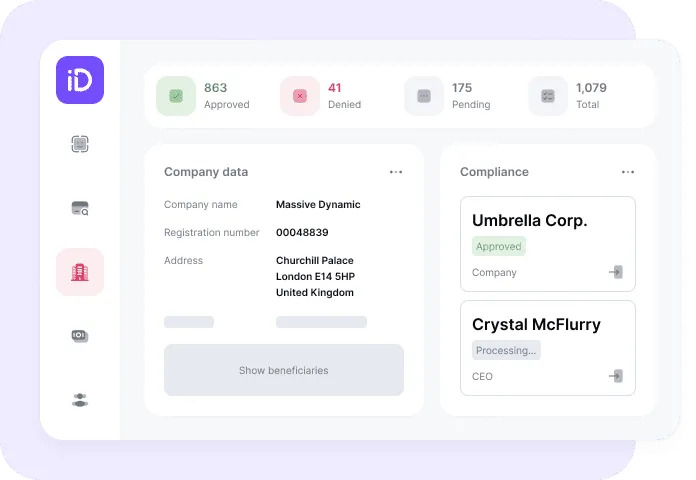

iDenfy is a full-service identity verification and fraud prevention platform. It offers risk scoring, proxy network detection, and sanctions and watchlist screening within a single dashboard.

iDenfy’s automated Know Your Customer (KYC), Know Your Business (KYB), and anti-money laundering (AML) workflows help companies across industries verify individuals and businesses in seconds while complying with the standards set by the GDPR, CCPA, and other privacy laws.

By combining advanced AI-driven checks (like ID validation, document analysis, and biometric and liveness detection) with human reviews, iDenfy enables businesses to verify users and detect potential fraud in real time. Plus, built-in audit logs streamline both internal reporting and regulatory audits.

Key features

- High accuracy ID and biometric checks: Leverages AI and human reviews to detect fraud.

- Risk scoring and sanctions screening: Automates AML, politically exposed person (PEP), and adverse media checks inline.

- Proxy and device detection: Flags potential fraud using IP address and other device-level analysis.

- KYB company verification: Checks business registries and verifies data, including ultimate beneficial owners (UBOs).

- Real-time dashboard insights: Monitors verification status, risk scores, and fraud alerts in one place.

Pricing plans

iDenfy pricing is based on business requirements. Organizations need to contact the company for details.

| Pros | Con |

| Real-time user verification | Optical character recognition can be inaccurate with certain document types, according to G2 users |

| Responsive customer support team, according to G2 users | |

| Easy to integrate with other tools, according to G2 users |

4. Workiva for automated reporting and audits

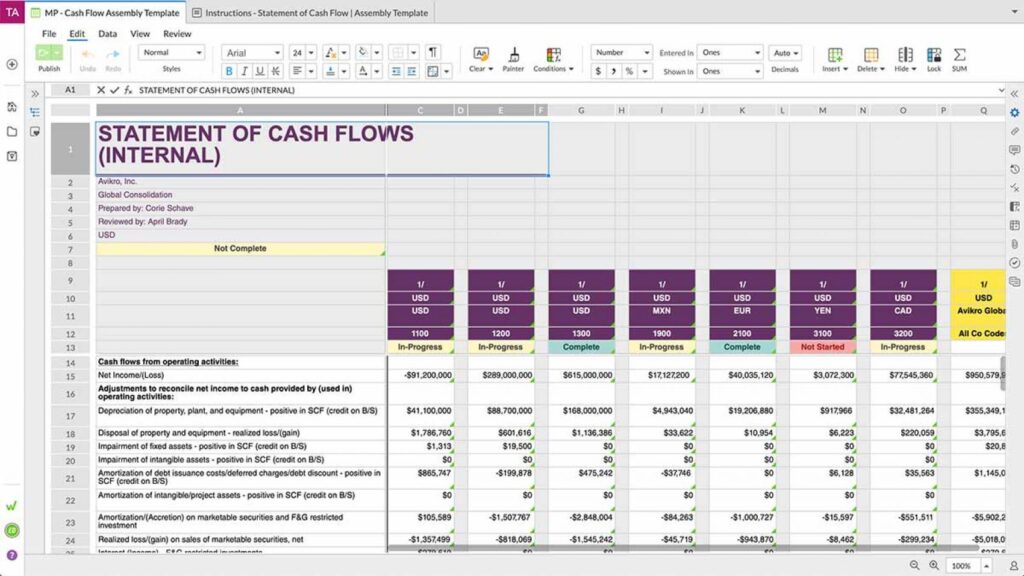

Workiva automates complex reporting, audits, and compliance workflows. It links data across disconnected spreadsheets, documents, and other data sources to reduce manual effort and human error.

By supporting simultaneous editing, version control, and real-time commenting, Workiva’s interface enables cross-team collaboration and helps ensure that updates in one place are automatically reflected across all formats.

The tool’s built-in audit trails and checkpoints, along with its straightforward interface, give teams greater transparency and control while reducing the friction typically associated with onboarding. This helps to increase the efficiency of both internal and external audit processes.

Key features

- Workiva AI: Accelerates reporting tasks with AI-assisted writing, data linking, and anomaly detection.

- Intelligent productivity: Automates repetitive workflows to free up time for high value compliance work.

- Unified reporting: Consolidates financial, ESG, and regulatory reports into a single, connected environment.

- Real-time collaboration: Enables multiple users to edit documents and data sources simultaneously, with versioning.

- Extensive partner network: Provides access to specialized support and integrations through vetted service providers and advisory firms.

Pricing plans

Workiva pricing is based on business requirements. Organizations need to contact the company for details.

| Pros | Con |

| Intuitive interface, according to G2 users | G2 users note that the Workiva system can be slow at times |

| Enables effective collaboration, according to G2 users | |

| Robust version control and transparency |

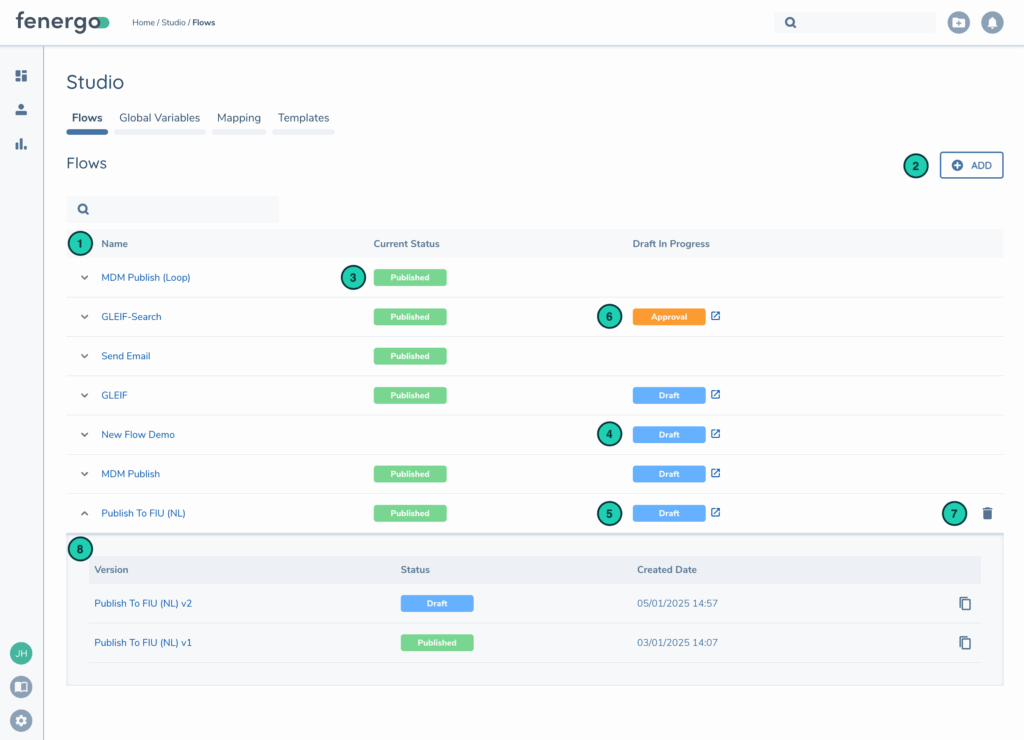

5. Fenergo for financial compliance

Fenergo is an enterprise-grade client lifecycle management (CLM) platform built to streamline financial compliance and onboarding workflows for banks, asset managers, insurers, and fintech.

It brings IT and regulatory compliance under one roof by integrating rules for KYC, AML, ESG (Environmental, Social, and Governance), tax, and derivatives across more than 120 jurisdictions.

Using no-code configurations and pre-packaged regulatory rule sets, Fenergo enables teams to automate due diligence and ongoing risk assessments without the need for in-house tech know-how. The platform’s cloud-native, API-first architecture and extensive integrations also mean that it can scale alongside your organization.

Key features

- Pre-packaged compliance rule sets: Covers tax, ESG, AML, KYC, and global derivatives out of the box.

- Hybrid AML transaction monitoring: Real-time financial crime detection with fewer false positives.

- Agentic AI: Built-in generative AI that automates document extraction, screening, and change detection.

- No-code configuration: Empowers teams to update policies and workflows without developer support.

- API-first CLM platform: Integrates seamlessly with Salesforce, Amazon Web Services (AWS), identity verification (IDV), and popular screening systems.

Pricing plans

Fenergo pricing is based on business requirements. Organizations need to contact the company for details.

| Pros | Con |

| All-in-one financial compliance coverage | Lack of clarity around pricing |

| AI-driven automation reduces manual workload | |

| Modular architecture enables quick deployment |

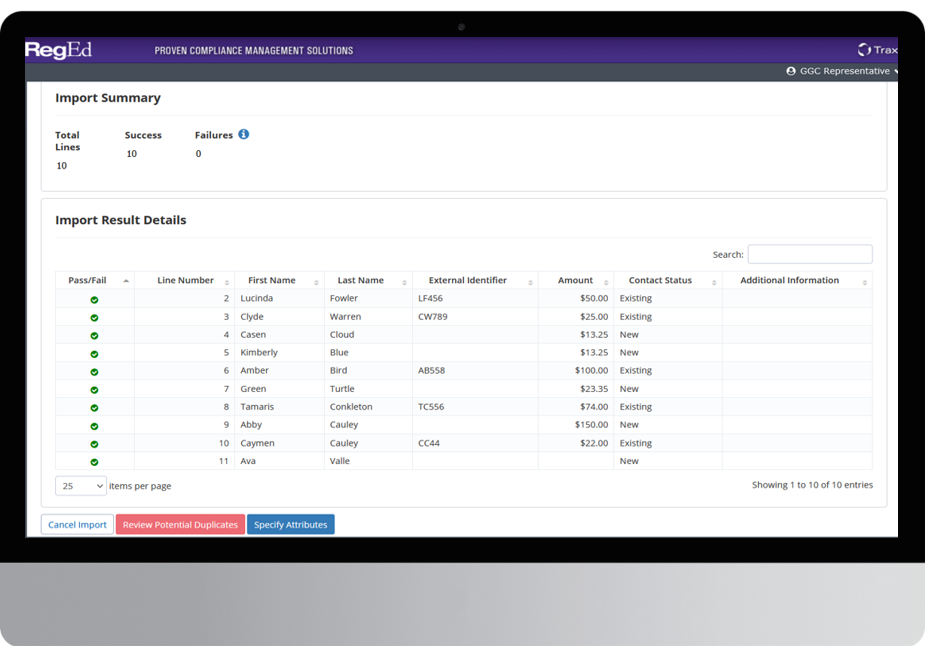

6. RegEd for compliance and regulatory training

RegEd is a compliance management and regulatory training platform designed primarily for financial services firms, broker-dealers, insurance companies, and banks.

Its unified dashboard streamlines compliance workflows and regulatory training. By consolidating tasks like onboarding, policy updates, branch inspection scheduling, and training into one scalable system, RegEd boosts efficiency and improves consistency across the compliance lifecycle.

The tool helps teams manage regulations from the Financial Industry Regulatory Authority (FINRA), Securities and Exchange Commission (SEC), and state departments; automate policy updates; administer mandatory training; and oversee branch audits, questionnaires, and advertising reviews from once place.

Key features

- Compliance SmartView: Provides real-time visibility into compliance statuses across users, branches, and workflows.

- Policy and procedure management: Centralizes documents with version control and scheduled reviews.

- Smart Disclosures: Automates disclosure updates and validations for faster, error-free compliance reporting.

- Complaint management: Captures, categorizes, and escalates complaints for resolution and reporting.

- Training tracking: Stores certificates, sends reminders, and allows for course management all in one place.

Pricing plans

RegEd pricing is based on business requirements. Organizations need to contact the company for details.

| Pros | Con |

| Unified compliance and training | Specifically designed for financial services firms, so may not be a good fit for businesses in other sectors |

| Strong audit and reporting capabilities | |

| AI-powered automation for compliance reviews |

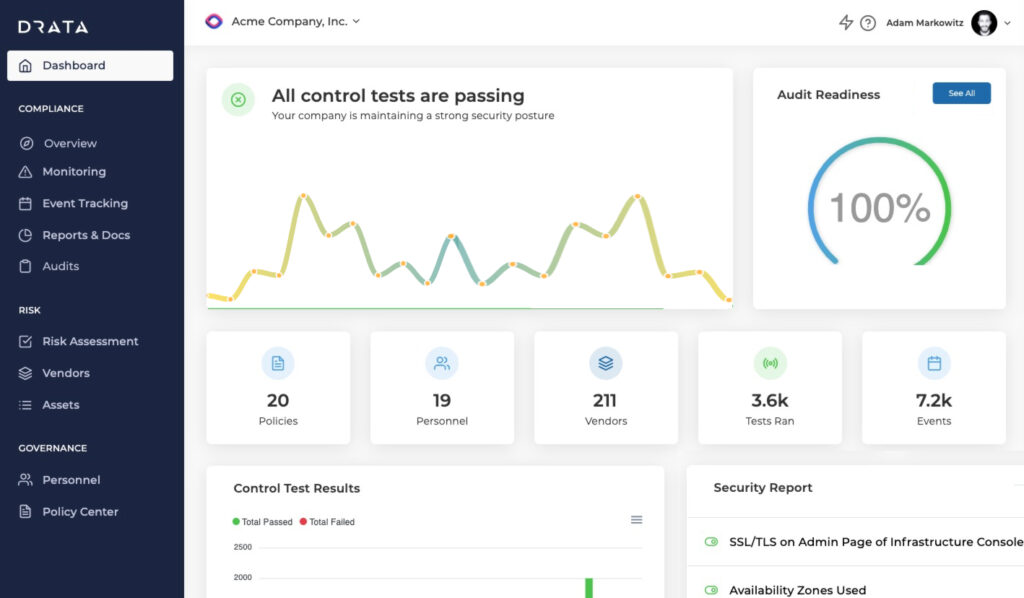

7. Drata for multi-regulation compliance

Drata helps businesses achieve multi-regulation compliance with minimal effort. It’s packed with support for over 20 frameworks, including SOC 2, ISO 27001, the Health Insurance Portability and Accountability Act (HIPAA), the Payment Card Industry Data Security Standard (PCI DSS), GDPR, CCPA, and the Federal Risk and Authorization Management Program (FedRAMP). Drata makes it simple to manage overlapping controls.

Unlike other Drata competitors, which focus on just one or two certifications, Drata is designed to scale with your compliance needs across multiple regulations from day one. Continuous monitoring enables you to keep a close watch on your data environment, and automated alerts help you catch potential compliance risks.

The platform’s unified dashboard gives teams a holistic view across frameworks and empowers non-technical and security teams alike to manage evidence, workflows, risk scoring, and policy enforcement without spreadsheets or manual followup.

Key features

- AI-Native trust management: Automates compliance and minimizes errors so you can implement trust management at scale.

- Compliance as Code: A solution that proactively enforces controls and addresses security gaps for continuous compliance across the software development lifecycle.

- Multi-framework support: Provides out‑of‑the‑box support for 20+ regulatory frameworks as well as custom controls.

- Continuous control monitoring: Performs real-time checks across cloud, HR, marketing, and other environments.

- Automated evidence collection: Gathers required evidence automatically, eliminating the need for manual uploads.

Pricing plans

- Drata pricing is based on business requirements. Organizations need to contact the company for details.

| Pros | Cons |

| Integrations across martech, security, and infrastructure tools | Some G2 users report issues with integrations, citing limitations like missing platforms and sync delays |

| User‑friendly dashboard, according to G2 users | |

| Continuous monitoring reduces audit preparation workload |

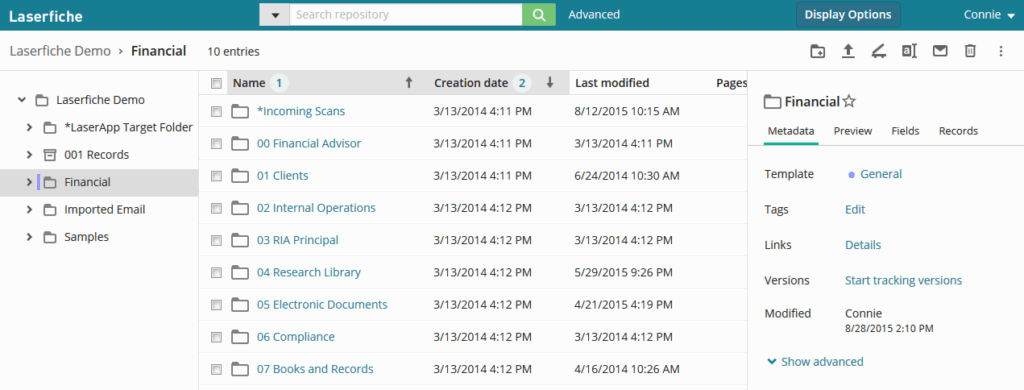

8: Laserfiche for information governance

Laserfiche automates content control throughout the document lifecycle, from capture to classification, retention, and disposal. The platform helps enable compliance with the GDPR, HIPAA, ISO 27001, and other key regulations.

By providing granular user access controls, encryption in transit and at rest, and detailed audit trails, Laserfiche helps organizations demonstrate accountability and meet stringent regulatory standards.

The low-code process automation engine enables you to build workflows for secure document sharing, electronic forms, and policy-driven retention schedules. Audit-ready features like Write Once, Ready Many (WORM)-compliant archiving help keep records defensible and tamper-proof.

Key features

- Pre-built workflows: Automated processes for approvals, routing, and retention based on proven workflows minimize manual data entry.

- Laserfiche AI: Uses machine learning to classify documents, detect patterns, and improve governance precision.

- SmartFields extraction: Captures structured and unstructured data from scanned or uploaded documents with high accuracy.

- Solution templates: Industry-specific templates help fast-track the deployment of governance and compliance use cases.

- Document and records governance: Built-in compliance controls help you enforce retention, legal holds, and audit policies.

Pricing plans

Laserfiche offers a number of plans based on your business size and needs. Prices as listed are billed annually.

- Starter: USD 45/user/month (up to nine users, self-hosted) or USD 50/user/month (up to four users, cloud hosted)

- Professional: USD 60/user/month (10+ users, self-hosted) or USD 69/user/month (5+ users, cloud hosted)

- Business: USD 69/user/month (25+ users, self-hosted) or USD 93/user/month (25+ users, cloud hosted)

- Enterprise: Custom pricing based on business needs; only available with self-hosting

| Pros | Con |

| Streamlines document management | Some G2 users report a potentially steep learning curve |

| High security and encryption standards | |

| Simple process automation, according to G2 users |

9. ServiceNow for AI-powered risk management

ServiceNow offers a robust AI-powered risk management solution as part of its Integrated Risk Management (IRM) suite. It delivers real-time intelligence, predictive insights, and automated workflows to help organizations detect, assess, and respond to risk at scale.

The platform uses AI to proactively identify high-impact risks and leverages historical data to predict potential issues, empowering teams to act before problems escalate. Its role-based dashboards and mobile-first design help align IT, security, and compliance teams around a single source of truth.

ServiceNow features governance, risk, and compliance (GRC) capabilities like automated policy lifecycles, unified risk registers, audit management, and regulatory change tracking. Its Now Assist GenAI also summarizes insights, automates workflow triggers, and resolves issues to reduce manual overhead and improve decision-making.

Key features

- AI risk agents: Automate risk identification, prioritization, and prescriptive recommendations.

- Predictive analytics: Uses historical data to forecast potential compliance threats ahead of time.

- Continuous monitoring: Tracks changes in the configuration management database, policies, and vendor data in real time.

- Now Assist: Generative AI that summarizes issues, auto-creates tasks, and suggests remediation workflows.

Centralized GRC workspace: Connects risk, policy, audit, and regulatory content across functions.

Pricing plans

ServiceNow pricing is based on business requirements. Organizations need to contact the company for details.

| Pros | Con |

| Comprehensive IRM with AI-driven oversight | Some G2 users note difficulties with customization and configuration |

| Unified platform ties risk to incidents, policies, and audits | |

| Predictive and prescriptive risk insights |

10. Scrut Automation for an all-in-one GRC platform

Scrut Automation brings together all the core functions of governance, risk, and compliance on one streamlined platform.

Designed to support 50+ frameworks (including SOC 2, ISO 27001, HIPAA, the GDPR, and PCI DSS) and equipped with built-in integrations for tools like AWS, Azure, Okta, and Zendesk, Scrut Automation helps organizations consolidate their compliance efforts without juggling multiple tools or spreadsheets.

The platform’s SmartGRC dashboard gives teams real-time visibility into risk exposure, control health, and workflow progress, while its AI-powered Teammates offer remediation suggestions and step-by-step guidance.

Key features

- SmartGRC automation: Streamlines audits and evidence collection with preset frameworks and reminders.

- Scrut Teammates: AI agents provide contextual insights and advice based on your data.

- Trust Vault: Centralizes audit-ready documentation to showcase compliance and support sales conversations.

- Pre-built policy library: Expert-approved policies mapped to key frameworks accelerate implementation and reduce setup time.

- Employee awareness: Built-in compliance training modules boost team knowledge and reduce risk across your organization.

Pricing plans

Scrut Automation pricing is based on business requirements. Organizations need to contact the company for details.

| Pros | Con |

| AI-powered GRC Teammates creates tickets, assigns owners, and tracks progress on tasks | Some G2 users report occasional software bugs |

| Real-time dashboards for compliance and risk exposure | |

| Support for 50+ regulatory frameworks |

Tips for choosing an automated regulatory compliance tool

Choosing the software you’ll use to automate your data privacy compliance tasks can be challenging, especially as you try to keep up with evolving regulations and customer expectations. The task becomes even more daunting when you consider the number of tools on the market.

To cut through the noise and find the software that will work best for you, Eike Paulat, Director of Product at Usercentrics, suggests looking for a flexible, scalable tool that offers coverage for the laws and integrations that are most important to your organization.

“Look for a solution that is legally and technologically robust. You’ll want solid regulatory coverage, automated updates, good integration coverage, and user-friendly implementation and maintenance, as well as flexibility and scalability to adapt to new laws and regions along with changes in the technologies in your tech stack,” he says.

“Customization is also key, both to ensure your brand and relevant regulations are reflected, and to be able to optimize the user experience and ensure it’s as user-friendly as possible. It’s good to note that robust backend functionality — like A/B testing capabilities, analytics, and reporting — also helps with that.”

Based on those recommendations, you’ll want to consider the following as you compare compliance automation tools:

- Regulatory fit: Verify that the platform supports the exact regulations your business must comply with, from the GDPR and CCPA to HIPAA and PCI DSS.

- Monitoring and alerts: Look for tools that proactively flag compliance issues, track regulatory changes, and support real-time oversight.

- Integration capabilities: Choose software that integrates smoothly with your existing tech stack, including your CRM, CMS, and HR platforms.

- Ease of implementation and use: A user-friendly interface and intuitive workflows reduce training time and encourage team-wide adoption.

- Scalability and adaptability: The tool should evolve with your business, supporting expansion into new markets and changes in your tech stack.

- Vendor support and training: Responsive support, clear documentation, and ongoing education can make a major difference over time.

Take the time to evaluate these factors up front to avoid roadblocks later and help ensure that your compliance program is built to scale alongside your business.

Achieve multi-regulation compliance with the right automation tool

Automating your regulatory compliance processes does more than save you time. By taking this step, you reduce your risk of noncompliance, increase accuracy in your data handling, and free your team from busywork.

The right tool can help you meet multiple regulatory requirements and maintain audit readiness while building a culture and reputation of trust and accountability.

If data privacy is a key part of your compliance strategy, Usercentrics makes it easier to get it right. With customizable consent solutions, automated policy updates, and broad regulatory coverage, we’ll help you achieve and maintain data privacy compliance while giving users more control and your marketing team more actionable, consented data.