Apple’s App Tracking Transparency (ATT) framework, introduced with iOS 14.5, transformed how personal data is managed online. By requiring apps to explicitly request user permission before tracking activities across apps and websites, ATT gives users greater control over their privacy. This shift, facilitated through the Identifier for Advertisers (IDFA), prioritizes transparency and empowers users to make informed choices.

For advertisers, app publishers, and end users, understanding ATT is critical. With iOS devices accounting for a significant share of the global market, the framework is reshaping the digital advertising landscape. It forces stakeholders to rethink long-standing practices, from delivering personalized ads to developing alternative attribution models.

Let’s explore what you need to know about Apple’s ATT, how it works, and the broader implications for privacy and advertising. Whether you’re a marketer, developer, or privacy advocate, this guide will help you navigate the changes with confidence.

What is App Tracking Transparency (ATT)?

App Tracking Transparency (ATT) was Apple’s response to growing concerns about user privacy. Designed to enhance transparency, the framework requires apps to ask users for permission through a tracking prompt — for example, when they install a new app — before accessing the Identifier for Advertisers (IDFA), a unique code that enables tracking for personalized advertising and campaign analysis.

Before ATT, iOS tracking often relied on implicit data collection practices, with little user awareness. The ATT framework replaced this with explicit opt-in consent. Through the prompt, users can either allow tracking or “Ask App Not to Track.” Denying permission blocks access to the IDFA, significantly limiting an app’s ability to track user behavior or deliver personalized ads.

How does Apple’s ATT framework work?

The ATT framework operates through a straightforward yet impactful system centered on user consent. Here’s how it works.

The role of the IDFA in tracking

The IDFA is integral to iOS app tracking transparency. This device-specific identifier allows advertisers to track user activity across apps and websites, enabling personalized ad delivery and detailed performance analysis. With ATT, apps must first secure user consent through the tracking prompt before they can access the IDFA. Without consent, the IDFA is inaccessible, limiting tracking capabilities and pushing advertisers to explore other methods.

What the ATT prompt looks like

When an app seeks to track user activity, a notification — the app tracking transparency prompt — appears. This prompt informs users about the app’s intention to track data and offers two clear options: “Allow” or “Ask App Not to Track.” Apple controls the design and language of the prompt for consistency across all apps, though developers can add a brief explanation to clarify the benefits of tracking.

Apple ATT policy and privacy goals

Apple’s decision to implement the App Tracking Transparency (ATT) policy stems from its commitment to strengthening user privacy. As digital ecosystems increasingly rely on personal data for targeted advertising, Apple has positioned itself as a leader in data privacy innovation. The Apple ATT policy helps users have full control over how their data is tracked and used within the iOS app tracking ecosystem.

Why did Apple introduce ATT?

The Apple ATT privacy initiative reflects growing public concern over invasive tracking practices and the lack of transparency in how data is collected, shared, and monetized. With ATT, Apple aims to:

- empower users by giving them a clear choice about tracking through the app tracking transparency prompt

- encourage accountability among app developers and advertisers by requiring explicit user consent for tracking

- align with global privacy trends, as consumer expectations for data protection and regulatory oversight continue to rise

How does ATT compare to GDPR?

While both Apple’s ATT policy and the General Data Protection Regulation (GDPR) prioritize user privacy, they differ in scope and application.

- Scope: GDPR is a comprehensive legal framework that governs all personal data processing within the EU. ATT, on the other hand, specifically addresses tracking within Apple’s iOS ecosystem.

- Implementation: ATT is enforced by Apple and applies to apps on its platform, while GDPR compliance is legally mandated across industries and geographies.

- Consent Mechanism: GDPR requires broad consent for personal data processing, often obtained through tools like Consent Management Platforms (CMPs). ATT focuses solely on the IDFA and tracking consent, with a standardized prompt controlled by Apple.

The impact of ATT on the app ecosystem

Apple’s ATT policy is more than just a privacy initiative, it’s a catalyst for change across the entire app ecosystem. By requiring explicit consent through the Apple ATT prompt, Apple has redefined how tracking is conducted, creating challenges and opportunities for advertisers, publishers, and app developers.

Impact on advertisers and publishers

The introduction of the Apple ATT prompt led to a noticeable drop in user opt-in rates. Many users are choosing to deny tracking permissions, making it more difficult for advertisers and publishers to access the data needed for personalized advertising. This significant decline in opt-in rates globally directly impacts how effectively advertisers can target and retarget users. Publishers, who rely on advertising revenue, have also experienced challenges as the value of their ad inventory has decreased without IDFA-enabled targeting. This shift underscores the growing need for new strategies that respect privacy while maintaining effective ad performance.

Changes in revenue streams

The limitations on iOS ATT tracking are also altering how apps generate revenue.

- Personalized advertising becomes more expensive: With fewer users opting in, competition for IDFA-enabled ad inventory increases, driving up costs for advertisers who rely on personalization.

- Shift toward paid apps: Many free apps, which historically relied on ad revenue, transitioned to paid models or subscription services to compensate for reduced income from advertising.

These changes highlight the growing importance of balancing user privacy with sustainable monetization strategies in an ATT-driven world.

Shift in advertising budgets

With the challenges posed by ATT, advertisers have reallocated budgets toward platforms that still allow more flexible tracking.

- Android as a fallback: Google’s platform offers advertisers access to its MAID (Mobile Advertising ID), making it a more attractive option for those seeking to maintain robust tracking capabilities.

- The possibility of Google following Apple’s lead: While Android currently permits broader tracking, Google has indicated that it may adopt similar measures in the future, further pushing the industry toward privacy-compliant advertising solutions.

This shift in budgets demonstrates how ATT has driven widespread changes in digital advertising strategies across platforms.

Read about Google additional consent now

Strategies for increasing ATT opt-in rates

With opt-in rates under the Apple ATT framework being a key concern for advertisers and app publishers, crafting an effective prompt strategy is essential. A well-designed Apple ATT prompt can make the difference between users opting in or declining, directly impacting your ability to deliver personalized experiences and maintain ad revenue.

Here are actionable tips and examples to help you optimize your ATT opt-in approach.

Communicate value to users

People are more likely to opt in for sharing their data if they understand how tracking benefits them. Use the customizable portion of the ATT prompt to explain the value of allowing tracking, such as:

- improved app functionality

- access to personalized content or recommendations

- free or ad-supported app usage

For example, a shopping app might say, “Allowing tracking helps us show you relevant products and exclusive offers tailored to your preferences.”

Be transparent and honest

Transparency fosters trust. Avoid vague or misleading language in your prompt strategy. Instead, clearly outline how data will be used and reassure users that their privacy is respected.

Example: “Your privacy is important to us. Tracking helps us deliver a more personalized experience while keeping the app free.”

Leverage timing to your advantage

The timing of the Apple ATT prompt can greatly influence user decisions. Present the prompt at a moment when the user is already engaged and seeing the value of your app. For example:

- after completing a key action, such as making a purchase or customizing settings

- during onboarding, paired with an explanation of how tracking enhances their experience

Use pre-prompt messaging

Before showing the official ATT prompt, display an in-app message (a pre-prompt) that explains what the user will see and why they should allow tracking. This prepares users and frames the request in a positive light.

Example: “We’d like to show you content you’ll love. Please allow tracking so we can offer personalized recommendations just for you.”

Optimize through testing. Every audience is different, so test various ATT opt-in strategies to find what resonates best.

Experiment with:

- different pre-prompt messages

- variations in timing and tone

- placement within the user journey

Track opt-in rates and user feedback to continuously refine your approach.

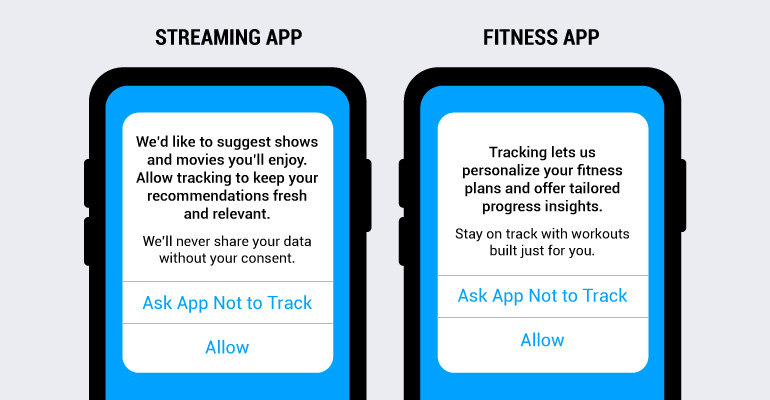

Examples of well-designed ATT prompts

- Streaming app example

- Pre-prompt: “We’d like to suggest shows and movies you’ll enjoy. Allow tracking to keep your recommendations fresh and relevant.”

- ATT prompt: Adds reassurance with a phrase like “We’ll never share your data without your consent.”

- Fitness app example

- Pre-prompt: “Tracking lets us personalize your fitness plans and offer tailored progress insights.”

- ATT prompt: Reinforces this message with, “Stay on track with workouts built just for you.”

By adopting these strategies, app publishers can increase ATT opt-in rates while building trust and delivering value to their users. A thoughtful prompt strategy not only enhances the likelihood of consent but also strengthens the user experience in the long run.

Preparing for the future of advertising with ATT in mind

Apple’s ATT framework has disrupted traditional advertising models, compelling businesses to explore privacy-compliant strategies for maintaining effectiveness. From embracing new attribution models to leveraging consent management platforms (CMPs), the future of advertising lies in innovation that aligns with evolving user expectations and regulatory standards.

Adapting to new attribution models

With iOS ATT limiting access to the Identifier for Advertisers (IDFA), advertisers must rely on alternative methods to measure campaign success. One such solution is Apple’s SKAdNetwork, a privacy-centric API designed for app install attribution.

How SKAdNetwork works

Instead of providing granular user data, SKAdNetwork aggregates information to attribute app installs to ad campaigns. This enhances privacy by eliminating user-level tracking while still providing insights into ad performance.

Benefits:

- preserves user privacy by eliminating device-level identifiers

- helps advertisers measure the effectiveness of campaigns within Apple’s ecosystem

- offers clarity for optimizing ad spend without violating privacy standards

While SKAdNetwork isn’t as detailed as IDFA-based tracking, it’s a crucial step toward new attribution models that balance privacy and performance.

Developing context-based advertising solutions

As individual tracking becomes more restrictive, advertisers are shifting to context-based solutions that focus on delivering ads relevant to the content and environment, rather than the user.

Context-based advertising

Context-based advertising targets ads based on the app’s content or the user’s immediate activity instead of relying on historical behavioral data. For example, an ad for running shoes might appear in a fitness app rather than being tied to a user’s past searches.

Opportunities:

- maintains relevance without needing personal data

- aligns with privacy expectations by eliminating user profiling

Challenges:

- requires creativity to identify meaningful contexts for ad placement

- offers less precision than behavior-based targeting, which may lead to lower ROI in some cases

For advertisers, context-based solutions represent a chance to rethink strategies and innovate in ways that respect user privacy while staying effective.

Leveraging consent management platforms (CMPs)

In an era of heightened privacy awareness, integrating a GDPR-compliant CMP is critical for helping data collection aligns with both regulatory and user expectations. CMPs provide a structured way to manage and document user consent, helping businesses maintain privacy compliance with frameworks like the GDPR and CCPA, working in conjunction with requirements like the ATT in iOS.

Why use a CMP in the ATT era?

When you’re determining out the right privacy compliance strategy for your business and marketing goals, a CMP can help:

- collect and manage consent for both ATT and broader data privacy regulations

- give transparency by giving users clear options to control their data

- help businesses avoid costly fines and maintain trust with users

How to implement a CMP effectively

Setting up a CMP can be quick, easy, and user-friendly. Automated features then help you reduce maintenance work load in the future.

- Integrate the CMP seamlessly into the user journey, with minimal disruption to the app experience.

- Use a CMP that supports privacy compliance across multiple regulations, such as the GDPR, CCPA, and LGPD

- Select a CMP that provides automated updates to reflect changes in legal and business requirements, and best practices, to maintain compliance.

Adapting to Apple’s ATT framework is essential for future-proofing your advertising strategy. From embracing privacy-friendly new attribution models like SKAdNetwork to shifting toward context-based advertising, businesses have opportunities to innovate and thrive in this era.